As a Massachusetts Realtor that has been doing quite a few successful short sales, one of the things I like to make sure of when I meet a potential client that is looking to do a short sale is to give them a complete understanding of how they work.

Short sales can be complicated transactions. Anyone who regularly participates in short sales knows that almost every single transaction is different. Every lender has their own set of rules on how they go about completing a short sale.

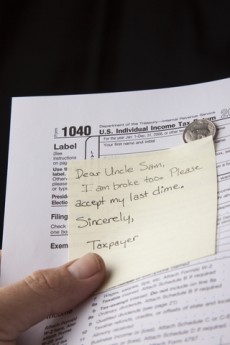

One of the things in particular that I feel is extremely important to educate a seller doing a short sale is the tax consequences. There are different sets of rules regarding short sale tax liability depending on whether or not the home was a primary residence or not.

If you are selling your primary residence as a short sale, The Mortgage Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt. The debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a short sale or foreclosure, qualifies for the relief granted.

The Mortgage Debt Relief Act applies to debt forgiven in calendar years 2007 through January 2014. The Debt Relief Act actually was set to expire at the end of 2012 however, congress has since extended the act for another year. Up to $2 million of forgiven debt is eligible for this exclusion or $1 million if married but filing separately. The exclusion does not apply if the discharge is due to services performed for the lender or any other reason not directly related to a decline in the home’s value or the taxpayer’s financial condition. This act was put in place for the specific purpose of helping home owners avoid the financial hardship caused by doing a short sale.

Prior to this relief act being put in place the IRS would treat the forgiveness of a debt as taxable income. The logic behind this is when you take out a mortgage there as an assumed obligation that you will be paying it back. When money is borrowed, the borrower is not required to include the loan proceeds as income because the borrower has to pay back the loan. When the obligation to pay back the loan is removed, the amount of the proceeds the buyer received becomes reportable as income because there is no longer an obligation to repay.

When there is a cancellation of debt, the lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C, Cancellation of Debt. Eligible home owners also must complete IRS form 982 which must be included with the Federal tax return to claim the mortgage relief.

If you are selling a property and it is not your principle residence you will be paying taxes on the short sale deficiency that is forgiven!

This is obviously a key consideration when determining whether doing a short sale is the right move or not. Debts forgiven that do not fall under the debt relief act include rental properties, business properties, 2nd homes and car loans. Credit cards also do not apply unless you were insolvent just prior to the cancellation of debt.

The most common situations when the cancellation of debt income is NOT taxable include:

- Qualified principal residence indebtedness: This is the exception created by The Mortgage Debt Relief Act of 2007 and applies to most homeowners.

- Bankruptcy: Debts discharged through bankruptcy are not considered taxable income.

- Insolvency: If you are insolvent when the debt is cancelled, some or all of the cancelled debt may not be taxable to you. You are insolvent when your total liabilities exceed the fair market value of your total assets.

- Certain farm debts: If you incurred the debt for the purpose of running a farm, more than half your income from the prior three years was from farming, and the loan was owed to a person or agency regularly engaged in lending, your cancelled debt is generally not considered taxable income.

- Non-recourse loans: A non-recourse loan is a loan for which the lender’s only remedy in case of default is to repossess the property being financed or used as collateral. In other words the lender is not allowed to pursue you personally in case of a default. Forgiveness of a non-recourse loan resulting from a foreclosure does not result in cancellation of debt income. However, it may result in other tax consequences.

Whenever I am dealing with a short sale and there are tax questions, I always recommend speaking to a qualified tax professional or attorney who is well versed in these matters.

One of the other things I would pay careful attention to is getting your Massachusetts short sale debt discharged. There are a lot of Realtors who are doing short sales and do not have a clue about debt release. You do not want to get caught with your pants down on this! Having a collection agency chase you for unpaid debts is probably not a pleasant experience!

Related Real Estate articles:

- Do you make Mortgage payments during a short sale?

- Questions to ask a short sale listing agent

- Picking a Massachusetts short sale attorney and Realtor

- Massachusetts Short Sale specialists

If you are needing to complete a short sale of your home or condo in Ashland, Bellingham, Blackstone, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Natick, Northboro, Northbridge, Shrewsbury, Southboro, Sutton, Wayland, Westboro, Whitinsville, Worcester, Upton and Uxbridge MA. Get in touch! I would love to interview for the chance to represent your best interests.

I am successfully completing short sales through out the Metrowest Massachusetts area. So far, knock on wood, I have a 100% success rate for short sale approval!

If you are not in the Metrowest Massachusetts area and need to do a short sale please feel free to contact me and I would be happy to refer you to a Realtor in your location that handles short sales and knows what they are doing!

_________________________________________________________________

About the author: The above Real Estate information on short sale tax consequences was provided by Bill Gassett, a Nationally recognized leader in his field. Bill can be reached via email at billgassett@remaxexec.com or by phone at 508-435-5356. Bill has helped people move in and out ofmany Metrowest towns for the last 24+ Years.

Thinking of selling your home? I have a passion for Real Estate and love to share my marketing expertise!

I service the following towns in Metrowest MA: Ashland, Bellingham, Blackstone, Douglas, Framingham, Franklin, Grafton, Holliston, Hopkinton, Hopedale, Medway, Mendon, Milford, Millbury, Millville, Natick, Northboro, Northbridge, Shrewsbury, Southboro, Sutton, Wayland, Westboro, Whitinsville, Worcester, Upton and Uxbridge MA.

Bill great article on understanding the tax ramifications with doing a short sale. I bet there are many people that do not realize there are different treatments for taxes on a primary v.s investment property.

Bill thanks so much for this information on short sales. I have a friend that may need to do a short sale on their home in Shrewsbury Massachusetts and I am going try to put him in contact with you. The short sale information you provide is outstanding.

Sam & Jen – Thanks for your compliments on my short sale articles! I would love to help anyone with their short sale. Knowing what you are doing when working with a short sale makes a BIG difference. I have not had a single short sale that did not get approved!

I have just short saled my primary residence, the loan proceeds from it was 62,000 dolars. This was given to BOA. However, the title co gave me a 1099s for that amount that the bank recieved. I know how to report the forginess of debt, but the $62,000 –do you know how this gets reported on an individual tax return?

My advice would be to consult your accountant but you should not have to pay taxes on this amount based on the tax relief act for short sales that was passed.

Thank you for the helpful information in the article. I am in the process of doing a short sale on Nantucket and am concerned about the possible tax consequences. Do you have a referral of a reliable MA real estate attorney that has a lot of experience with short sales?

Many thanks,

Jodi

Hi Jody – Yes I would be happy to help you with a good short sale attorney. Please feel free to call me at 508-435-5356 to discuss your short sale.

Bill this is a great information for so many people thinking about what to do. People need to understand everything about doing a short sale.

The IRS created a “logical” reason that creates income from debt. Only in America. Hope we will all wake up one day to realize how “entitlements” can only be paid by taking hard earned money away from hard working Americans. Eliminate big government, and we can eliminate the IRS insatiable appetite to find ways to take our money from us. Wouldn’t it be nice to eliminate big government, thus eliminating the need for the IRS?

Besides, we all know banks are actually making money on short sales. Look into what banks paid for loans (discounted from original price) and what they short sold for – and the taxpayer is still stuck with “income” taxes.

Thank you so much again Bill for this very informative post. Your writings are always filled with great and useful information.

Thanks for the info. I did a short sale on the South Shore of Massachusetts.

Thanks for all of your helpful articles regarding short sales. In your experiences with short sales in Massachusetts, could you recommend one or two good accountants that are familiar with short sales in Massachusetts? Thanks again for all of your interesting and helpful posting.

Dee

Hi Dee – I could give you the name of my accountant who is probably well versed enough to answer any short sale questions you may have. I will shoot you an email.

My question is this…. When bidding on a short sale is the prospective buyer able to know at that point what liens, 2nd mortgages or property tax arrears are on the property?

Hi Tom – What you would need to do is have an attorney do a title search for you to be certain what exactly encumbers the property.

Hi Bill, thanks so much for the helpful info! quick question.. i went to get my taxes prepared and my accountant said from everything he’s read that after a short sale, the mortgage debt relief act only applies to the federal govt.. and that i would still be taxed from the state on the canceled debt? any thoughts?

Hi Kara – Yes your accountant is correct that the mortgage debt relief act only applies to your federal taxes. In order not to pay state taxes at least here in Massachusetts you would need to show that you were insolvent.

Great points, Bill! This is perhaps the number one question I get from educated borrowers: what happens to me taxwise when I do a short sale? They know that something is going to happen, but they’re not sure what. Homeowners are so relieved when they find out about the Debt Relief Act. I hope this is something that will be extended past 2012!

Russ

The sale price of my house (which is nearing the final stages of a short sale) is around 65,000 and the mortgage is 215,000 (ouch). Do I have to deal with the CLAW consequences and report 150,000 as income in one year?? Truley an impossible feat for me. I’ve been unemployed for nearly 3 years and I’m really on the financial ropes now. Any thoughts on this matter would be grealy appreciated as I am having a hard time understanding mess. Many thanks, L. Parker

Lincoln it would depend on whether the home was your primary residence or not. The debt relief act generally negates a borrower paying taxes in a short sale if the home was their primary residence. This is for Federal taxes. You will need to check with your state regarding state taxes.

Thanks for posting this. It’s very difficult to find detailed and trustworthy info about short sales on the webs. Much appreciated!

Thanks Stephen. Always happy to help provide info on short sales to those that need my help.

Is the federal tax relief good to 2011 or 2012. I have seen both dates in all my readings.

Jack The Debt Relief Act is in place until the end of 2012.

Is there anything like the Mortgage Debt Relief Act of 2007 for the state of Mass.? It seems unfair that families desperate enough to short sale the homes they can’t afford get socked with bills for thousands of dollars from Mass DOR.

Susan unfortunately there is not. Massachusetts does not recognize the debt relief act. In order not to pay Mass taxes on a short sale you need to show that you are insolvent.

Bill,

I just closed on a short sale on a rental property in Mass. I live out of state i owed (186,681.40 ) the property short sold for $135,000 and the bank only rec’d $118,649.78 the diff of ($89,462.48) am i still responsible for paying off the remaining balance? How will the remaining balance be reported to the IRS. I have not received any info from the bank as of yet. I had funds in my escrow/impound overdraft of $3,000 where does this money go now? confused about the whole short sale process and afraid that i will be paying out of my butt with taxes due to this short sale. Please explain!

Rhonda – you need to check and see what the approval letter for your short sale says. There should be language in the short sale approval letter that states whether the lender has retained the right to collect what you owe in the future. The lender could be reporting that they did not collect on the debt in which case you probably do not owe any Federal taxes under the debt relief act. I would suggest you check with an accountant or qualified tax professional. The state of Massachusetts does not recognize the debt relief act. You will need to pay Mass taxes unless you can show you are insolvent.

My mother died in NJ at the age of 56. As her only heir, I became Executor of her Estate. However, her Estate had a value of $3500 total; I had to pay for most of the funeral, and everything else, myself. She owed $140K on her house, and it sold in a short sale for $66K less than she owed, after Bank of America first tried to sued the Estate and me personally. I was told I would not be responsible for the debt forgiveness since I had nothing to do with the mortgage; it would go under my mother’s name since the mortgage was only in her name. However, I just received a K-1 for $66K debt forgiveness, in my name and social security number!! What is going on – I don’t have to report it as income do I? I didn’t receive a penny from the house sale or the Estate – in fact, I had to spend my own money to pay for the funeral, bond, and other expenses!

Hi Megan – Great question but unfortunately I am not qualified to answer it. I would check with a qualified tax professional.

I made a mistake, it is a 1099-K form they sent me. I will contact the company that sent it to me and tell them they made a mistake. Hopefully they will fix it. Thank you!

Bill,

The Mortgage debt relief act of 2007 seems clear in the sense that you are exempt from the amount forgiven in the short sale of your home based on your 1099C. But is it true that if you have rewritten your mortgage over the life of the loan and used any additional money taken on the property for anything else but home improvements this relief act does not apply or is reduced by that amount. Also, if trying to prove insolvency, do you have to be insolvent by the total amount forgiven by the bank? Meaning the amt on the 1099C or insolvent by any dollar amount?

Susan you are correct the mortgage monies had to be used for the home. For example if you refinanced and bought a car or went on a trip there would be tax ramifications because that money had nothing to do with the home. As far as being in solvent for Massachusetts tax purposes you would just need to show your debt is greater than your assets.

Bill,

If you buy a short sale at 80K but the real value of the property is 100K, would the buyer be responsible for any taxes on the 20K difference?

Hi Stacy – No there are no tax concerns from a buyer’s stand point when it comes to a deficiency in a short sale,

I am currently getting screwed on the aftermath of my short sale of two family home. This article has helped. Wish I was guided correctly before by other professionals. Now I owe 10K-14K from Salem MA…. still ironing out before officially filing taxes.

Jenny as you have unfortunately found out there are a lot of real estate agents who are not educated enough to be doing short sales. This is a problem that is now catching up to a lot of people who were not properly informed of the ramifications of a short sale.