Financial Preparation Before Looking at Houses

Too often home buyers fail to prepare themselves financially before looking for a home to purchase. Doing so is a common mistake that many future home buyers make even though this may be the largest purchase of their lives.

Too often home buyers fail to prepare themselves financially before looking for a home to purchase. Doing so is a common mistake that many future home buyers make even though this may be the largest purchase of their lives.

Not taking the proper steps to set yourself up for success could mean that you do not get your dream home, or it costs you more than it should.

Here are some of the best tips for preparing yourself financially before starting the home search process. By doing so you’ll be two steps ahead of the game and well on your way to home ownership!

Connect with a Lender Far in Advance

Getting the best home loan should be one of your primary goals when buying a house.

Before you start driving around neighborhoods, flipping through listings online or even stopping in to speak with a Realtor, it would be a good idea to know what your buying power is today.

If you have a goal to be able to buy into a particular neighborhood, you should put a plan in place to be able to achieve that.

Speaking with a lender first to develop a plan of action on how you can qualify to buy a home in that area or price range is critical.

My recommendation is that you have an initial discussion with a lender nine months to one year in advance. Sound crazy? I know many people do not know that far in advance that they may be buying a home next year. For those who do, this is extremely important.

Why is it Important to Plan So Far in Advance?

First, your lender will let you know what you can qualify for today based upon your income, down payment and credit score. There are other factors which play a part including credit events and large monthly payments on your credit report.

Your Income is Vital

Income – Income sometimes is difficult to change in one year. Lenders will be looking at your last two years’ tax returns and recent pay stubs when you are ready to apply. They will also require that you have a two-year work history.

Some individuals decide to take a break for personal reasons without realizing that a gap in employment may prevent them from getting loan approval.

Documenting your income is essential as well. If you are in a cash business, then you should begin depositing that money into an account on a regular basis so that you can qualify for a bank statement loan. These are just a few examples of what your lender will discuss with you.

The Down Payment Makes a Big Difference

Down Payment – This is extremely important, and it will partially determine your buying power. It is also connected to the various loan programs that you may or may not qualify for. You will need to have those down payment funds in your bank account three months before you submit a loan application.

If you have little to no down payment and do not think you can raise additional funds over the next nine months, then your lender will discuss low down payment and loan program options which will then help determine your realistic price range.

If you can get to a twenty percent down payment that is ideal. When you don’t have at least twenty percent to put down, you’ll often be required to pay private mortgage insurance.

PMI is a useless fee that only benefits the lender as protection in the event you default on your loan. Most people will try to stop paying private mortgage insurance as soon as they can.

Credit Scores Play a Significant Role When Getting a Mortgage

Credit Score – Your credit score plays a significant role here. It will have an impact on your final mortgage rate, in some instances your down payment requirement, or whether you are qualified at all for a mortgage. Borrowers with the best credit scores generally will get the lowest mortgage interest rate. Therefore it makes sense to put a lot of work into improving your financial status.

The good news though is that it is not that hard to improve your credit scores in as little as 6 months or less. There are creative ways to do it yourself and even some reputable services out there who know how to get your scores raised for you.

Do your best to target a score of 680 or above. There are lenders that can find a bad credit mortgage for you with scores as low as 500 but then your down payment requirement and your rate will be much different.

Credit Events Are Important Too

Credit Events – A credit event is a bankruptcy, foreclosure and in some instances collections. If you have a bankruptcy or foreclosure, your lender needs to know up front so he or she can plan for this. It is preferable to have had these two years prior to applying for a loan.

Less than two years out of bankruptcy for example will prevent you from getting an FHA loan. Collections need to be dealt with. Pay outstanding collection amounts and work to have them removed from your credit report. That can be negotiated with the creditor as part of the payment agreement.

Avoiding Large Payments on Your Credit Report is Smart

Large Payments on Your Credit Report – Too often potential home buyers fail to qualify because they have too many other minimum monthly payments showing up on their credit report. During the qualification process, lenders need to factor your future mortgage payment as well as the monthly obligations that appear on your credit report.

Together, and when divided into your gross monthly income they make your debt to income ratio (DTI). Each loan program has a maximum DTI allowed. The less that you have in OTHER monthly payments on your credit report, the larger the loan you will be able to qualify for.

A Good Example

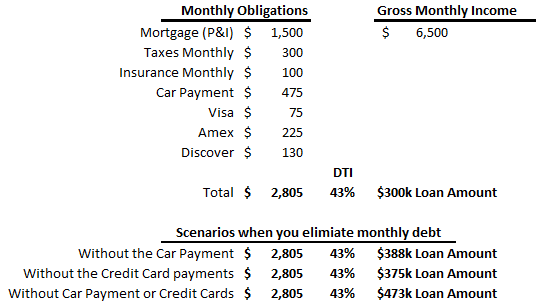

In this example, you can see that with a gross monthly income of $6,500, this person would qualify for a $300k loan at current rates using a maximum DTI of 43%. At the bottom, you can see how much more buying power this person has when the other monthly payments are removed.

This example above should hopefully explain why it is important to keep your credit report free from other monthly obligations. If you think there is a chance that you may buy a home in the near future, then do not buy a new car. At least not without discussing the implications with your lender.

In the example above, the person could afford $88k more if there was no car payment when applying for the loan. The truth is that auto lending is much more lenient when it comes to qualifying. Once you are approved and close on your home loan, there is an excellent chance that you can then go and buy the car you want.

Reserve Funds

The cash needed to buy a home is not just about the down payment and closing costs. Lenders will require a few months’ reserves (check with your lender). They want to be sure that if you have a job loss that you can at least make a few payments before you are out of money.

Realistically, you need to plan for a lot more than that. When you buy your home, do you think you may need some money to fix it up the way you want? Even with new construction, there are expenses.

Do you need to buy furniture? Do you own basic home needs like a lawn mower? This is also part of the planning process. Throwing everything you have into your initial purchase without anything left over makes you “house poor” and with one small setback can land you in a very difficult scenario where you could lose your home.

Final Perspective

Once you have this plan developed with the assistance of a lender, then you can target price points and specific towns or neighborhoods. You will be able to spend time focusing on homes that are a true reality for you.

Developing a plan far in advance and sticking to it will also help make the home buying process much easier and will take the stress out of finding a mortgage. Your realtor will also be pleasantly surprised to know that you have taken the time to make sure you have the ability financially to purchase the home.

If you are thinking about looking for a home at some point in the future, contact a lender today to have a preliminary discussion.

Additional Helpful Mortgage and Financing Articles Worth Reading

Use these additional home buying resources to make sound financial decisions.

About the author – Eric Jeanette started as a Realtor in 1993 and eventually transitioned to lending. His company Dream Home Financing provides mortgage information and education to consumers. They also provide those same consumers with a free lender match service through a network of lenders for conventional, government, low credit score, self-employed and many other niche loan programs.

About the author – Eric Jeanette started as a Realtor in 1993 and eventually transitioned to lending. His company Dream Home Financing provides mortgage information and education to consumers. They also provide those same consumers with a free lender match service through a network of lenders for conventional, government, low credit score, self-employed and many other niche loan programs.

Buyers who follow this advice and prepare their financial home will have no difficulty in finding their physical home.